21-01-24 The Week Ahead

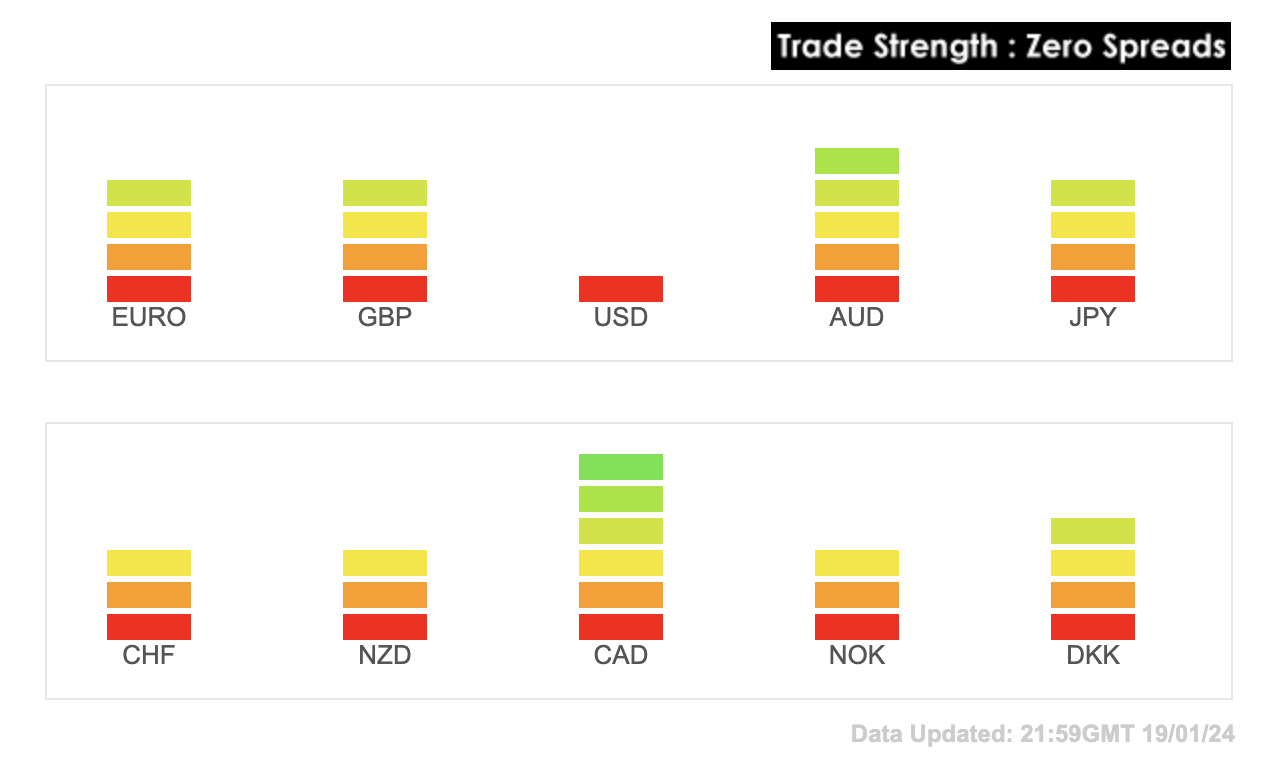

Strength Indicator:

The Currency Strength Indicator

The Currency Strength Indicator

Purely looking at this strength chart might suggest that there should be movement on the USD/CAD pair. We’ll probably use this as a bias for corroborating any Price Action indication that we see in the USD and CAD markets.

Let’s start with USD/CAD:

It looks like the downward trend might have been broken, but with the USD weakness and the CAD strength, I’m inclined to think that the downward trend will at least be retested in the Gold Fib zone. I’ll be looking for a suitable entry and a target towards 1.33350

AUD/USD:

Again taking the Strength of AUD and weakness of USD, I’m bullish (at least for the short term) for this pair. I’m looking for a retracement to just over the red 200SMA which coincides with the Gold Fib Retracement level. Target 0.67150

NZD/USD:

Now ignoring the Strength Indicator, I’m bearish this pair. The last time this pair spent any real time above the 200SMA was 2020. I’m looking for a move towards 0.60500 and we’ll reassess there. It could retrace from there to the 200SMA to make the right hand shoulder before decending lower.

GBP/AUD:

Sentiment: Short-term Bearish. I’d like to see a retrace to the fib50, at about 1.90000. Thats a nice whole number that sits just below the 9, and 20SMa and slap bang on the FIB50.

GBP/CAD:

Sentiment: Short-term Bearish. I’d like to see a retrace to the fib50, at about 1.6950. Thats a nice whole number that sits just below the 9, and 20SMa and slap in the FIB Gold zone. After that I think we can see it continue higher to 1.72750

EUR/AUD:

EUR/AUD Daily

Going to wait for a touch of the 0.382 Fib before heading long.

The JPY Pairs:

USD/JPY Daily

CAD/JPY Daily

EUR/JPY Daily

GBP/JPY Daily

NZDJPY Daily

AUD/JPY Daily

I’m bullish all these. GBPJPY is testing territory its not seen since 2015.

The Rest of the Bunch:

Nothing else jumps out at me yet. GBPUSD looks to me to be in a consolidation phase. slap in the middle of a channel.

the CHF pairs I have an unhealthy reluctance to trade, I got burned back in 2011 when they decided to introduce negative interest rates…